Are you paying too much for trademark renewals?

by Volker Spitz, CEO, Brandstock

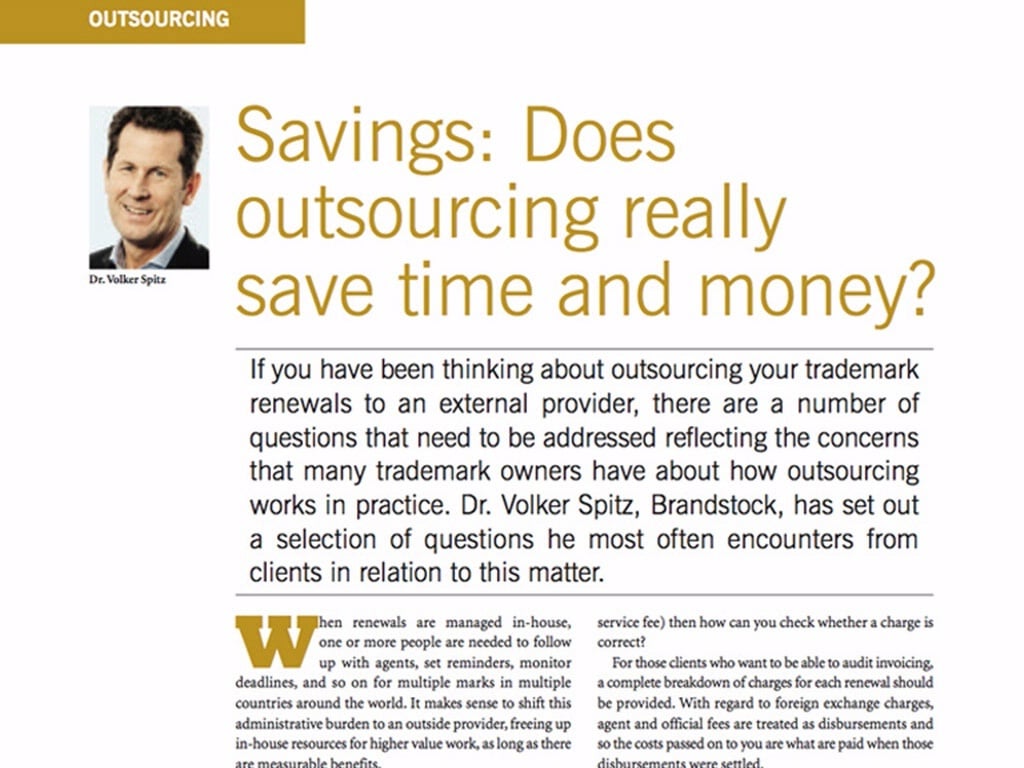

Making sure that mark-ups have not applied to official fees, or checking that incorrect exchange rates have not been applied, has not been on the IP agenda for decades; primarily because budgets for renewing trademarks were readily available, but also because the sector had become accustomed to an almost complete lack of transparency.

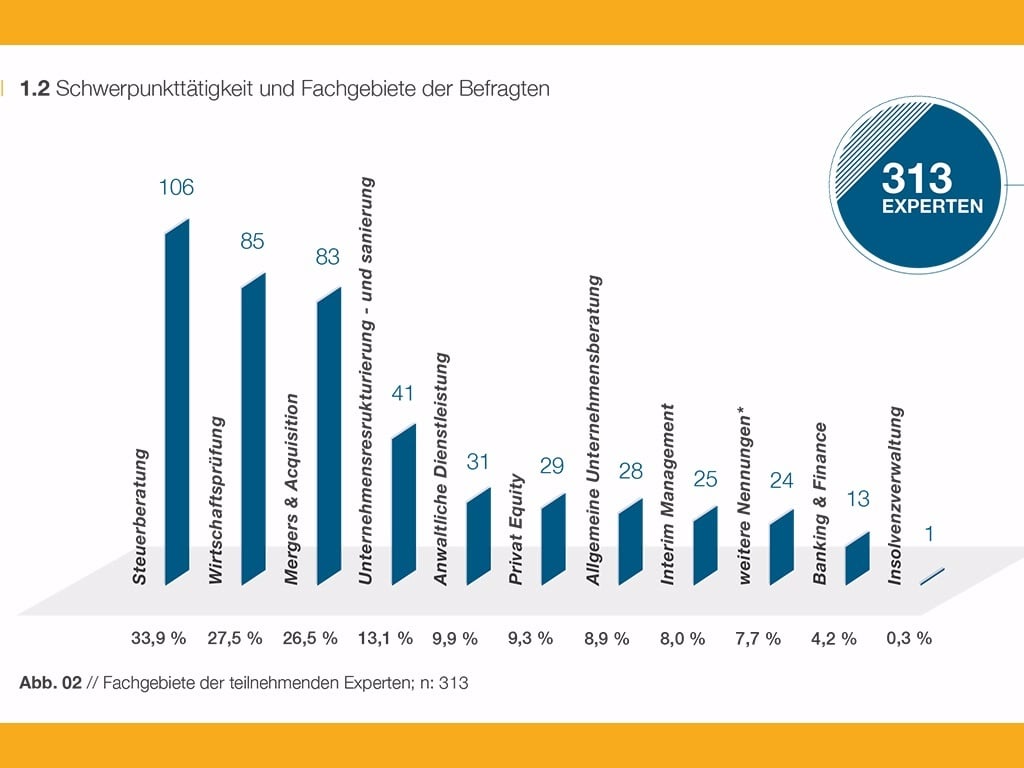

Having conducted more than 150 agent benchmarking projects for the owners of some of the world’s largest trademark portfolios, and reviewed thousands of invoices for renewal payments, we believe we now have enough information from which to draw some conclusions.

Commoditization

Renewal payments are becoming ever more ‘commoditized’; in other words, the processes involved are well and narrowly defined; are largely automated; and require little more than accuracy in their execution.

The decision whether to appoint a new renewals provider is often solely based on their handling fee and only in very few cases are the competiveness of local law firm charges; the use of correct official fees; and correct FX rates taken into consideration.

Competition, and commoditization, can only be relied on to push prices down so far. Certain practices have sprung up in order to counteract the downward pressure on fees, and therefore profitability:

- Inflated Official Fees

Trademark owners are still paying hefty mark-ups, generally between 30 and 50% (and, in some cases, as much as 1,500%).

- Inflated Foreign Exchange (FX)

It is an open secret that FX is being used by some to artificially inflate charges and yet the majority of IP owners seem blissfully unaware of or indifferent.

- Inflated local law firm fees

Many firms charge what they can get away and in the absence of benchmarked pricing IP owners have no means of knowing.

Solutions

Service must be paid for one way or another. Unfeasibly low handling fees and attorney fees will inevitably mean that quality suffers or that profitability will be assured by other means.

So what can be done to safeguard against inflated fees and hidden markups?

RFPs

RFPs must include the evaluation of local agent fees and official fees in local currency. Agent fees must be benchmarked against peer group data and official fees have to be checked against the fee schedules published by local patent and trademark offices.

Agent Benchmarking

Trademark owners have to ensure that they are obtaining the best fees from providers and that local law firms are affording them their most competitive fees – irrespective of the size of the portfolio. This can easily be achieved through a benchmarking project as offered by Brandstock which can be completed in under six months.

SLAs and Billing Guidelines

SLAs and Billing Guidelines must incorporate provisions dealing with the application of official fees and FX rates such as: being able to identify the official fee in local currency in every invoice; and details of FX rates along with their source and the conversion date. With regard to FX rates, it is suggested that a general margin of up to 5% could be accepted as an industry standard. SLAs also have to include provisions related to the review of charges made and compensation in the event of irregularity.

Official fees

Clients must ensure that they have ready access to accurate and up-to-date official fees in local currency. The easiest way to achieve this is to make use of the proprietary calculation tools provided by Brandstock.

Random invoice checking

Invoices, including disbursements in local currency, have to be subject to random checks. Generally it is sufficient to concentrate on the regions “known” for irregularities. This service is already offered not only by Brandstock but also by other renewalsproviders.

Electronic Billing Systems

These systems must work with modified Ledes codes and should be able to automatically check invoices against agreed local agent fees and accurate official fees.

Conclusions

Whether you take a moral or purely financial view of overcharging, it fundamentally undermines trust in what should be a trustworthy profession.

Transparency is undoubtedly driving change in business and the IP sector is not immune from its consequences. Information asymmetry, still exploited by many to their financial advantage, is becoming less acceptable and is no longer a necessary evil to be tolerated in the name of expediency. Until the IP industry has the equivalent of an online market in which suppliers must participate if they are to do business, and through which all costs can be compared, benchmarking exercises can and do serve to bring costs into line and ensure that you are not paying too much for trademark renewals.